# !pip install multidispatch0 INTRODUCTION

In part 3 we added stockout costs as well as holding costs to complicate Mr. Optimal’s task of managing the number of Elantras and Sonatas on his dealership space of 57 lots. So far, he has chosen to partition the 57 lots between the models as 40 for Elantras and 17 for Sonatas. These parameters were indicated by

We will also make the code more generic so that it can be scaled up in the future without too much trouble. For example, instead of hardcoding variables, we often access them by traversing the entity names list eNames.

The overall structure of this project and report follows the traditional CRISP-DM format. However, instead of the CRISP-DM’S “4 Modeling” section, we inserted the “6 step modeling process” of Dr. Warren Powell in section 4 of this document. Dr Powell’s unified framework shows great promise for unifying the formalisms of at least a dozen different fields. Using his framework enables easier access to thinking patterns in these other fields that might be beneficial and informative to the sequential decision problem at hand. Traditionally, this kind of problem would be approached from the reinforcement learning perspective. However, using Dr. Powell’s wider and more comprehensive perspective almost certainly provides additional value.

Here is information on Dr. Powell’s perspective on Sequential Decision Analytics.

In order to make a strong mapping between the code in this notebook and the mathematics in the Powell Unified Framework (PUF), we follow the following convention for naming Python identifier names:

- Superscripts

- variable names have a double underscore to indicate a superscript

X__pi, is read X pi

- Subscripts

- variable names have a single underscore to indicate a subscript

S_t, is read ‘S at t’M__Spend_twhich is read: “MSpend at t”

- Arguments

- collection variable names may have argument information added

X__piIS_tI, is read ‘X pi in S at t’- the surrounding

I’s are used to imitate the parentheses around the argument

- Next time/iteration

- variable names that indicate one step in the future are quite common

R_tt1, is read ‘R at t+1’R__nt1, is read ‘R at n+1’

- Rewards

- State-independent terminal reward and cumulative reward

Ffor terminal rewardcumFfor cumulative reward

- State-dependent terminal reward and cumulative reward

Cfor terminal rewardcumCfor cumulative reward

- State-independent terminal reward and cumulative reward

- Vectors where components use different names

S_t.R_tandS_t.p_t, is read ‘S at t in R at t, and, S at t in p at t’- the code implementation is by means of a named tuple

self.State = namedtuple('State', SVarNames)for the ‘class’ of the vectorself.S_tfor the ‘instance’ of the vector

- Vectors where components reuse names

x_t.x_t_GBandx_t.x_t_BL, is read ‘x at t in x at t for GB, and, x at t in x at t for BL’- the code implementation is by means of a named tuple

self.Decision = namedtuple('Decision', xVarNames)for the ‘class’ of the vectorself.x_tfor the ‘instance’ of the vector

- Use of mixed-case variable names

- to reduce confusion, sometimes the use of mixed-case variable names are preferred (even though it is not a best practice in the Python community), reserving the use of underscores and double underscores for math-related variables

1 BUSINESS UNDERSTANDING

Inventory management is a critical component of any business, whether it be a small retail store or a multinational corporation. At its core, inventory management is the process of tracking and controlling a company’s inventory, from raw materials to finished products. Proper inventory management is important for several reasons.

First and foremost, inventory management helps businesses avoid stock overages and underages (overstocks and stockouts). By tracking inventory levels and forecasting demand, businesses can ensure that they always have the right amount of product on hand to meet customer needs without overbuying and tying up capital in excess inventory. This helps businesses maintain a healthy cash flow and avoid costly stockouts that can result in lost sales and dissatisfied customers.

In addition, effective inventory management can help businesses streamline their operations and improve their overall efficiency. By reducing excess inventory and optimizing order quantities and lead times, businesses can minimize waste and improve their supply chain management. This can lead to cost savings, improved profitability, and increased customer satisfaction.

Finally, inventory management is critical for businesses that need to comply with regulatory requirements, such as those in the pharmaceutical or food industries. Proper inventory tracking and documentation can help businesses meet these requirements and avoid costly fines and penalties.

Overall, inventory management is an essential function for any business that wants to operate efficiently, meet customer demand, and maximize profitability. Effective inventory management requires careful planning, accurate data, and the right tools and processes to ensure that businesses always have the right amount of product on hand, at the right time, and at the right cost.

In this project the client had a need to be convinced of the benefits of formal optimized sequential decision making. This was provided in the form of a series of POCs.

2 DATA UNDERSTANDING

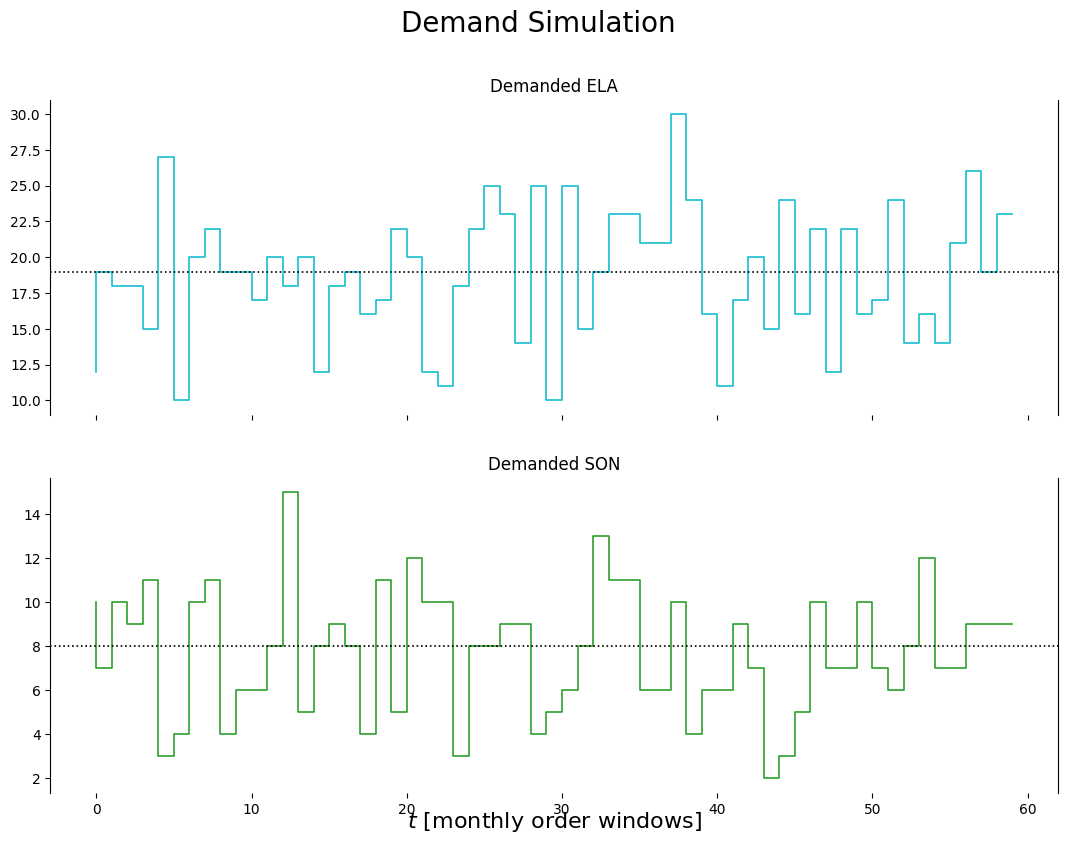

Based on recent market research, the demand may be modeled by two Poisson distributions with means:

We will simulate the inventory demand for Elantras,

Similarly,

the inventory demand for Sonatas,

The order window is 1 month and these simulations are for the monthly demands.

# import pdb

from collections import namedtuple, defaultdict

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from copy import copy

import time

from scipy.ndimage.interpolation import shift

import pickle

from bisect import bisect

import math

from pprint import pprint

import matplotlib as mpl

from certifi.core import where

pd.options.display.float_format = '{:,.4f}'.format

pd.set_option('display.max_columns', None)

pd.set_option('display.max_rows', None)

pd.set_option('display.max_colwidth', None)

! python --versionPython 3.10.11DeprecationWarning: Please use `shift` from the `scipy.ndimage` namespace, the `scipy.ndimage.interpolation` namespace is deprecated.

from scipy.ndimage.interpolation import shiftThe parameters of the inventory system under management (SUM) are:

SNames = ['R_t', 'D_t']

xNames = ['x_t']

eNames = ['ELA', 'SON']

piNames = ['X__BuyBelow']

T__sim = 60 #50 #100

muD = {'ELA': 19, 'SON': 8}

eventTimeD = {'ELA': None, 'SON': None}

muDeltaD = {'ELA': None, 'SON': None}

p__buy = {'ELA': 19_300, 'SON': 22_100} #dollars

p__sell = {'ELA': 23_470, 'SON': 27_250} #dollars

# R__maxELA = 40 #spaces #is now learned

# R__maxSON = 17 #spaces #is now learned

c__interest = 0.05/12

c__upkeep = {'ELA': 28.43, 'SON': 34.72} #dollars per itemclass DemandSimulator():

def __init__(self,

T__sim,

muD,

eventTimeD,

muDeltaD):

self.time = 0

self.T__sim = T__sim

self.muD = muD

self.eventTimeD = eventTimeD

self.muDeltaD = muDeltaD

def simulate(self):

if self.time > T__sim - 1:

self.time = 0

D_tt1 = {}

for e in eNames:

if self.eventTimeD[e] and self.time > self.eventTimeD[e]: #event for entity

D_tt1[e] = self.muDeltaD[e] + np.random.poisson(self.muD[e]) #after event

else:

D_tt1[e] = np.random.poisson(self.muD[e])

self.time += 1

return {e: max(0, D_tt1[e]) for e in eNames} #always positivedem_sim = DemandSimulator(

T__sim=T__sim,

muD=muD,

eventTimeD=eventTimeD,

muDeltaD=muDeltaD)

DemandData = []

for i in range(T__sim):

d_e = list(dem_sim.simulate().values())

DemandData.append(d_e)

labels = [f'{e}_demand' for e in eNames]

df = pd.DataFrame.from_records(data=DemandData, columns=labels); df[:10]| ELA_demand | SON_demand | |

|---|---|---|

| 0 | 12 | 10 |

| 1 | 19 | 7 |

| 2 | 18 | 10 |

| 3 | 18 | 9 |

| 4 | 15 | 11 |

| 5 | 27 | 3 |

| 6 | 10 | 4 |

| 7 | 20 | 10 |

| 8 | 22 | 11 |

| 9 | 19 | 4 |

import random

def plot_output(df1, df2):

n_charts = len(eNames)

ylabelsize = 16

mpl.rcParams['lines.linewidth'] = 1.2

default_colors = plt.rcParams['axes.prop_cycle'].by_key()['color']

fig, axs = plt.subplots(n_charts, sharex=True)

fig.set_figwidth(13); fig.set_figheight(9)

fig.suptitle('Demand Simulation', fontsize=20)

for i,e in enumerate(eNames):

axs[i].set_title(f'Demanded {e}')

axs[i].set_ylim(auto=True); axs[i].spines['top'].set_visible(False); axs[i].spines['right'].set_visible(True); axs[i].spines['bottom'].set_visible(False)

axs[i].step(df1[f'{e}_demand'], random.choice(default_colors))

axs[i].axhline(y=dem_sim.muD[e], color='k', linestyle=':')

axs[i].set_xlabel('$t\ \mathrm{[monthly\ order\ windows]}$', rotation=0, ha='center', va='center', fontweight='bold', size=ylabelsize)

plot_output(df, None)

seed = 189654913

file = 'Parameters.xlsx'# NOTE:

# R__max: maximum number of inventory units

# R_0: initial number of inventory units

parDf = pd.read_excel(f'{base_dir}/{file}', sheet_name='ParamsModel', index_col=0); print(f'{parDf}')

parDict = parDf.T.to_dict('list') #.

params = {key:v for key, value in parDict.items() for v in value}

params['seed'] = seed

params['T'] = min(params['T'], 192); print(f'{params=}') 0

Index

Algorithm GridSearch

T 195

eta 1

R__max 57

R_0 0

params={'Algorithm': 'GridSearch', 'T': 192, 'eta': 1, 'R__max': 57, 'R_0': 0, 'seed': 189654913}parDf = pd.read_excel(f'{base_dir}/{file}', sheet_name='GridSearch', index_col=0); print(parDf)

parDict = parDf.T.to_dict('list')

paramsPolicy = {key:v for key, value in parDict.items() for v in value}; print(f'{paramsPolicy=}')

params.update(paramsPolicy); pprint(f'{params=}') 0

Index

theta_sell_min 10

theta_sell_max 100

theta_buy_min 10

theta_buy_max 100

theta_inc 1

paramsPolicy={'theta_sell_min': 10, 'theta_sell_max': 100, 'theta_buy_min': 10, 'theta_buy_max': 100, 'theta_inc': 1}

("params={'Algorithm': 'GridSearch', 'T': 192, 'eta': 1, 'R__max': 57, 'R_0': "

"0, 'seed': 189654913, 'theta_sell_min': 10, 'theta_sell_max': 100, "

"'theta_buy_min': 10, 'theta_buy_max': 100, 'theta_inc': 1}")pprint(f"{params=}")("params={'Algorithm': 'GridSearch', 'T': 192, 'eta': 1, 'R__max': 57, 'R_0': "

"0, 'seed': 189654913, 'theta_sell_min': 10, 'theta_sell_max': 100, "

"'theta_buy_min': 10, 'theta_buy_max': 100, 'theta_inc': 1}")3 DATA PREPARATION

We will use the data provided by the simulator directly. There is no need to perform additional data preparation.

4 MODELING

4.1 Narrative

As pointed out in the introduction, this fourth project in the Inventory Series expands the problem in part 3 to have four parameters:

To remind the reader, we have the following setting: Mr. Optimal is an inventory manager for the largest dealership in a big city. He is responsible to manage the inventory levels of the two mentioned Hyundai models. He has a maximum number of lot spaces assigned to him (which is 57). So far, Mr. Optimal decided to reserve a maximum of 40 spaces for the Elantras. The remaining 17 spaces will be used for Sonata. In this project he will instead rely on the two learned values for the maximum number of spaces for the two models. He has a choice to strive to always keep these spaces occupied by new cars. This way he is unlikely to run out of stock and lose a sale due to that. However, capital is tied up by the unsold inventory in his lot space.

At the other extreme, he may choose to work on a just-in-time principle: Each time a potential customer expresses interest in a model, the customer will have to wait until he obtains a new car from the supplier. Of course, he will likely lose the sale, but the upside is that no capital is tied up in his inventory.

It seems intuitive that the optimal levels of inventory will be somewhere between these extremes. The challenge is to find that optimal levels. For now, we will assume that the buy and sell prices will remain constant. The only random variables will be the demands for these models. Another assumption is that ordered inventory will arrive immediately.

Unsatisfied demands are lost, i.e. there will be no ability to backlog unsatisfied demands. However, a stockout cost is incurred when demand is unsatisfied. Moreover, existing inventory brings about a holding cost for each item. The latter cost is usually made up of lost interest on cash used to buy the item as well as upkeep cost. Under upkeep we could think of making sure batteries are kept in a charged state, fuel associated with drive arounds to showcase a vehicle, as well as costs associated with keeping the vehicles clean and groomed.

4.2 Core Elements

This section attempts to answer three important questions: - What metrics are we going to track? - What decisions do we intend to make? - What are the sources of uncertainty?

For this problem, the only metric we are interested in is the amount of profit we make after each decision window. A single type of decision needs to be made at the start of each window - how many new cars to order of each model. The only source of uncertainty are the levels of demand for the models.

4.3 Mathematical Model | SUM Design

A Python class is used to implement the model for the SUM (System Under Management):

class InventoryStorageModel():

def __init__(

self, SNames, xNames, eNames, params, exogParams, possibleDecisions,

p__buy, p__sell, W_fn=None, S__M_fn=None, C_fn=None):

...

...4.3.1 State variables

The state variables represent what we need to know. -

The state is:

The state variables are represented by the following variables in the InventoryStorageModel class:

self.SNames = SNames

self.State = namedtuple('State', SNames) # 'class'

self.S_t = self.build_state(self.S_0) # 'instance'where

SNames = ['R_t', 'D_t']4.3.2 Decision variables

The decision variables represent what we control.

- number of Elantras and Sonatas ordered (

- number of Elantras and Sonatas ordered (

- Constraints

- Decisions are made with a policy (TBD below):

The decision variables are represented by the following variables in the InventoryStorageModel class:

self.Decision = namedtuple('Decision', xNames) # 'class'where

xNames = ['x_t']4.3.3 Exogenous information variables

The exogenous information variables represent what we did not know (when we made a decision). These are the variables that we cannot control directly. The information in these variables become available after we make the decision

We assume that any unsatisfied demand is lost. Additionally, we assume that the demand in each time period is revealed, so that we have:

The exogenous information is obtained by a call to

DemandSimulator.simulate(...)

The latest exogenous information can be accessed by calling the following method from class InventoryStorageModel():

def W_fn(self, t):

W_tt1_ELA, W_tt1_SON = dem_sim.simulate()

W_ttl = {'ELA': W_tt1_ELA, 'SON': W_tt1_SON}

return W_ttl4.3.4 Transition function

The transition function describe how the state variables evolve over time. Because we currently have two state variables in the state,

Collectively, they represent the general transition function:

class InventoryStorageModel():

def S__M_fn(self, x_t, Dhat_tt1):

R_tt1 = {e: max( 0, self.S_t.R_t[e] - min(self.S_t.R_t[e], self.S_t.D_t[e]) + x_t.x_t[e] ) for e in eNames} #max to keep >0

D_tt1 = {e: Dhat_tt1[e] for e in eNames}

S_tt1 = self.build_state({

'R_t': {e: R_tt1[e] for e in eNames},

'D_t': {e: D_tt1[e] for e in eNames}

})

return S_tt14.3.5 Objective function

The objective function captures the performance metrics of the solution to the problem.

First, let us state the stockout and holding costs:

We can write the state-dependant reward (also called contribution) based on what we will receive between

Alternatively, we can write the state-dependant reward based on what we will receive between

because, from (Eq. 1) and (Eq. 2) above:

This is a stochastic expression due to the dependence on the random variable

This second form leads to the objective function:

The contribution (reward) function is implemented by the following method in class InventoryStorageModel:

def C_fn(self, x_t):

Dhat_tt1 = dem_sim.simulate()

c__sout = {e: self.p__sell[e]*max(self.S_t.D_t[e] - self.S_t.R_t[e], 0) for e in eNames} #unmet demand

c__hold = {e: c__interest*self.p__buy[e] + c__upkeep[e] for e in eNames} #interest & upkeep

C = 0

for e in eNames:

C += self.p__sell[e]*min((self.S_t.R_t[e] - min(self.S_t.R_t[e], self.S_t.D_t[e]) + x_t.x_t[e]), Dhat_tt1[e]) \

- self.p__buy[e]*x_t.x_t[e] - c__sout[e] - c__hold[e]

return C, Dhat_tt1 #pass along exog_info, else data is skipped/wasted4.3.6 Implementation of SUM Model

Here is the complete implementation of the InventoryStorageModel class:

class InventoryStorageModel():

def __init__(

self, SNames, xNames, eNames, params, exogParams, possibleDecisions,

p__buy, p__sell, W_fn=None, S__M_fn=None, C_fn=None):

self.initArgs = params

self.prng = np.random.RandomState(params['seed'])

self.exogParams = exogParams

self.S_0 = {

'R_t': {e: params['R_0'][0] for e in eNames},

'D_t': {e: 0 for e in eNames},

}

self.SNames = SNames

self.xNames = xNames

self.eNames = eNames

self.possibleDecisions = possibleDecisions

self.p__buy = p__buy

self.p__sell = p__sell

self.State = namedtuple('State', SNames) #. 'class'

self.S_t = self.build_state(self.S_0) #. 'instance'

self.Decision = namedtuple('Decision', xNames) #. 'class'

self.cumC = 0.0 #. cumulative reward

def reset(self):

self.cumC = 0.0

self.S_t = self.build_state(self.S_0)

def build_state(self, info):

return self.State(*[info[sn] for sn in self.SNames])

def build_decision(self, info):

return self.Decision(*[info[xn] for xn in self.xNames])

def W_fn(self, t):

W_tt1_ELA, W_tt1_SON = dem_sim.simulate()

W_ttl = {'ELA': W_tt1_ELA, 'SON': W_tt1_SON}

return W_ttl

def S__M_fn(self, x_t, Dhat_tt1):

R_tt1 = {e: max( 0, self.S_t.R_t[e] - min(self.S_t.R_t[e], self.S_t.D_t[e]) + x_t.x_t[e] ) for e in eNames} #max to keep >0

D_tt1 = {e: Dhat_tt1[e] for e in eNames}

S_tt1 = self.build_state({

'R_t': {e: R_tt1[e] for e in eNames},

'D_t': {e: D_tt1[e] for e in eNames}

})

return S_tt1

# based on what we will receive between t and t+1 (i.e. looking *forward* relative to (S_t,x_t) #.

# RLSO-Eq8.5

def C_fn(self, x_t):

Dhat_tt1 = dem_sim.simulate()

c__sout = {e: self.p__sell[e]*max(self.S_t.D_t[e] - self.S_t.R_t[e], 0) for e in eNames} #unmet demand

c__hold = {e: c__interest*self.p__buy[e] + c__upkeep[e] for e in eNames} #interest & upkeep

C = 0

for e in eNames:

C += self.p__sell[e]*min((self.S_t.R_t[e] - min(self.S_t.R_t[e], self.S_t.D_t[e]) + x_t.x_t[e]), Dhat_tt1[e]) \

- self.p__buy[e]*x_t.x_t[e] - c__sout[e] - c__hold[e]

return C, Dhat_tt1 #pass along exog_info, else data is skipped/wasted

def step(self, t, x_t):

C, Dhat_tt1 = self.C_fn(x_t)

self.cumC += C

self.S_t = self.S__M_fn(x_t, Dhat_tt1)

return (self.S_t, self.cumC, x_t) #. for plotting4.4 Uncertainty Model

We will simulate the inventory demand vector

4.5 Policy Design

There are two main meta-classes of policy design. Each of these has two subclasses: - Policy Search - Policy Function Approximations (PFAs) - Cost Function Approximations (CFAs) - Lookahead - Value Function Approximations (VFAs) - Direct Lookaheads (DLAs)

In this project we will only use one approach: - A simple buy below parameterized policy (from the PFA class)

The buy below policy is implemented by the following method in class InventoryStoragePolicy():

def X__BuyBelow(self, t, S_t, theta, T): #theta is a vector

info = {

'x_t': {'ELA': 0, 'SON': 0}

}

if t >= T:

print(f"ERROR: t={t} should not reach or exceed the max steps ({T})")

return self.model.build_decision(info)

theta__buy_ELA = theta[0]

R__maxELA = theta[2]

if S_t.R_t['ELA'] <= theta__buy_ELA: # BUY if R_t_ELA <= theta__buy_ELA

info['x_t']['ELA'] = R__maxELA - S_t.R_t['ELA']

theta__buy_SON = theta[1]

R__maxSON = theta[3]

if S_t.R_t['SON'] <= theta__buy_SON: # BUY if R_t_SON <= theta__buy_SON

info['x_t']['SON'] = R__maxSON - S_t.R_t['SON']

return self.model.build_decision(info)4.5.1 Implementation of Policy Design

The InventoryStoragePolicy() class implements the policy design.

import random

# from multidispatch import dispatch

from certifi.core import where

class InventoryStoragePolicy():

def __init__(self, model, piNames):

self.model = model

self.piNames = piNames

self.Policy = namedtuple('Policy', piNames)

def X__BuyBelow(self, t, S_t, theta, T): #theta is a vector

info = {

'x_t': {'ELA': 0, 'SON': 0}

}

if t >= T:

print(f"ERROR: t={t} should not reach or exceed the max steps ({T})")

return self.model.build_decision(info)

theta__buy_ELA = theta[0]

R__maxELA = theta[2]

if S_t.R_t['ELA'] <= theta__buy_ELA: # BUY if R_t_ELA <= theta__buy_ELA

info['x_t']['ELA'] = R__maxELA - S_t.R_t['ELA']

theta__buy_SON = theta[1]

R__maxSON = theta[3]

if S_t.R_t['SON'] <= theta__buy_SON: # BUY if R_t_SON <= theta__buy_SON

info['x_t']['SON'] = R__maxSON - S_t.R_t['SON']

return self.model.build_decision(info)

def run_policy(self, piInfo, piName, params):

model_copy = copy(self.model)

T = params['T']

for t in range(T): #for each transition/step

x_t = getattr(self, piName)(t, model_copy.S_t, piInfo, T) # piInfo is theta value

_, _, _ = model_copy.step(t, x_t)

cumC = model_copy.cumC

return cumC

def perform_grid_search(self, params, thetas):

tS = time.time()

cumCI_theta_I = {}

bestTheta = None

i = 0; print(f'... printing every 100th theta ...')

for theta in thetas:

if i%100 == 0: print(f'=== {theta=} ===')

cumC = self.run_policy(theta, "X__BuyBelow", params)

cumCI_theta_I[theta] = cumC

best_theta = max(cumCI_theta_I, key=cumCI_theta_I.get)

# print(f"Finishing theta {theta} with cumC {cumC:,}. Best theta so far {best_theta}. Best cumC {cumCI_theta_I[best_theta]:,}")

i += 1

print(f"Finishing GridSearch in {time.time() - tS:.2f} secs")

print(f"Best theta: {best_theta}. Best cumC: {cumCI_theta_I[best_theta]:,}")

return cumCI_theta_I, best_theta

def run_policy_sample_paths(self, T, L, theta, pi, record): #theta could be a vector

FhatIomega__lI = []

for l in range(1, L + 1): #for each sample-path

model_copy = copy(self.model)

record_l = [pi, theta, l]

for t in range(T): #for each transition/step

x_t = getattr(self, pi)(t, model_copy.S_t, theta, T)

# _, _, _ = model_copy.step(t, x_t)

S_t, cumC, x_t = model_copy.step(t, x_t)

record_t = [t] + [S_t.R_t[e] for e in eNames] + [S_t.D_t[e] for e in eNames] + [cumC] + [x_t.x_t[e] for e in eNames]

record.append(record_l + record_t)

FhatIomega__lI.append(model_copy.cumC) # just above (SDAM-eq2.9); Fhat for this sample-path is in model_copy.cumC

return FhatIomega__lI

def perform_grid_search_sample_paths(self, T, L, thetas, pi):

tS = time.time()

Fhat_mean = None

Fhat_var = None

Fhat__meanI_th_I = defaultdict(float) #{}

Fhat__stdvI_th_I = defaultdict(float) #{}

num_thetas = len(thetas)

record = []

i = 0; print(f'... printing every 20th theta if considered ...')

for theta in thetas:

# theta__buy_ELA < theta_max_ELA

# theta__buy_SON < theta_max_SON

# theta_max_ELA + theta_max_SON == 57

if( (theta[0] < theta[2]) and \

(theta[1] < theta[3]) and \

(theta[2] + theta[3] == 57) ):

if i%20 == 0: print(f'=== ({i:,} / {num_thetas:,}), {theta=} ===')

FhatIomega__lI = self.run_policy_sample_paths(

T, L, theta, pi, record)

Fhat_mean = np.array(FhatIomega__lI).mean() #. (SDAM-eq2.9); call Fbar in future

Fhat_var = np.sum(np.square(np.array(FhatIomega__lI) - Fhat_mean))/(L - 1)

Fhat__meanI_th_I[theta] = Fhat_mean

Fhat__stdvI_th_I[theta]= np.sqrt(Fhat_var/L)

best_theta = max(Fhat__meanI_th_I, key=Fhat__meanI_th_I.get)

# print(f"Finishing theta {theta} with cumC {Fhat__meanI_th_I[best_theta]:,}. Best theta so far {best_theta}. Best cumC {Fhat__meanI_th_I[best_theta]:,}")

i += 1

print(f"Finishing GridSearch in {time.time() - tS:.2f} secs")

print(f"Best theta: {best_theta}. Best cumC: {Fhat__meanI_th_I[best_theta]:,}")

return Fhat__meanI_th_I, Fhat__stdvI_th_I, best_theta, record

# dispatch {prepend @}

# def grid_search_theta_values(self, thetas0): #. using vectors reduces loops in perform_grid_search_sample_paths()

# thetas = [(th0,) for th0 in thetas0]

# return thetas

# dispatch {prepend @}

# def grid_search_theta_values(self, thetas0, thetas1): #. using vectors reduces loops in perform_grid_search_sample_paths()

# thetas = [(th0, th1) for th0 in thetas0 for th1 in thetas1]

# return thetas

# dispatch {prepend @}

# def grid_search_theta_values(self, thetas0, thetas1, thetas2): #. using vectors reduces loops in perform_grid_search_sample_paths()

# thetas = [(th0, th1, th2) for th0 in thetas0 for th1 in thetas1 for th2 in thetas2]

# return thetas

def grid_search_theta_values(self, thetas0, thetas1, thetas2, thetas3): #. using vectors reduces loops in perform_grid_search_sample_paths()

thetas = [(th0, th1, th2, th3) for th0 in thetas0 for th1 in thetas1 for th2 in thetas2 for th3 in thetas3]

return thetas

def plot_Fhat_map(self, Fhat__mean, thetasX, thetasY, labelX, labelY, title, theta__max_ELA, theta__max_SON):

# Fhat_values = [FhatI_theta_I[(thetaX,thetaY)] for thetaY in thetasY for thetaX in thetasX]

Fhat_values = [Fhat__mean[(thetaX,thetaY, theta__max_ELA,theta__max_SON)] for thetaY in thetasY for thetaX in thetasX]

Fhats = np.array(Fhat_values)

increment_count = len(thetasX)

Fhats = np.reshape(Fhats, (-1, increment_count))

fig, ax = plt.subplots()

im = ax.imshow(Fhats, cmap='hot', origin='lower', aspect='auto')

# create colorbar

cbar = ax.figure.colorbar(im, ax=ax)

# cbar.ax.set_ylabel(cbarlabel, rotation=-90, va="bottom")

# we want to show all ticks...

ax.set_xticks(np.arange(0,len(thetasX), 5))

ax.set_yticks(np.arange(0,len(thetasY), 5))

# ... and label them with the respective list entries

ax.set_xticklabels(thetasX[::5])

ax.set_yticklabels(thetasY[::5])

# rotate the tick labels and set their alignment.

#plt.setp(ax.get_xticklabels(), rotation=45, ha="right",rotation_mode="anchor")

ax.set_title(title, fontsize=16)

ax.set_xlabel(labelX)

ax.set_ylabel(labelY)

#fig.tight_layout()

plt.show()

return True

def plot_Fhat_maps(self,

Fhat__mean, Fhat__stdv,

thetasX, thetasY, labelX, labelY, title_mean, title_stdv,

theta__max_ELA, theta__max_SON):

# Fhat_values = [FhatI_theta_I[(thetaX,thetaY)] for thetaY in thetasY for thetaX in thetasX]

Fhat_values = [Fhat__mean[(thetaX,thetaY, theta__max_ELA,theta__max_SON)] for thetaY in thetasY for thetaX in thetasX]

Fhats = np.array(Fhat_values)

increment_count = len(thetasX)

Fhats = np.reshape(Fhats, (-1, increment_count))

fig, ax = plt.subplots()

im = ax.imshow(Fhats, cmap='hot', origin='lower', aspect='auto')

# create colorbar

cbar = ax.figure.colorbar(im, ax=ax)

# cbar.ax.set_ylabel(cbarlabel, rotation=-90, va="bottom")

# we want to show all ticks...

ax.set_xticks(np.arange(0,len(thetasX), 5))

ax.set_yticks(np.arange(0,len(thetasY), 5))

# ... and label them with the respective list entries

ax.set_xticklabels(thetasX[::5])

ax.set_yticklabels(thetasY[::5])

# rotate the tick labels and set their alignment.

#plt.setp(ax.get_xticklabels(), rotation=45, ha="right",rotation_mode="anchor")

ax.set_title(title_mean, fontsize=16)

ax.set_xlabel(labelX)

ax.set_ylabel(labelY)

#fig.tight_layout()

print()

Fhat_values = [Fhat__stdv[(thetaX,thetaY, theta__max_ELA,theta__max_SON)] for thetaY in thetasY for thetaX in thetasX]

Fhats = np.array(Fhat_values)

increment_count = len(thetasX)

Fhats = np.reshape(Fhats, (-1, increment_count))

fig, ax = plt.subplots()

im = ax.imshow(Fhats, cmap='hot', origin='lower', aspect='auto')

# create colorbar

cbar = ax.figure.colorbar(im, ax=ax)

# cbar.ax.set_ylabel(cbarlabel, rotation=-90, va="bottom")

# we want to show all ticks...

ax.set_xticks(np.arange(0,len(thetasX), 5))

ax.set_yticks(np.arange(0,len(thetasY), 5))

# ... and label them with the respective list entries

ax.set_xticklabels(thetasX[::5])

ax.set_yticklabels(thetasY[::5])

# rotate the tick labels and set their alignment.

#plt.setp(ax.get_xticklabels(), rotation=45, ha="right",rotation_mode="anchor")

ax.set_title(title_stdv, fontsize=16)

ax.set_xlabel(labelX)

ax.set_ylabel(labelY)

#fig.tight_layout()

plt.show()

return True

def plot_Fhat_chart(self, FhatI_theta_I, thetasX, labelX, labelY, title, color_style):

mpl.rcParams['lines.linewidth'] = 1.2

xylabelsize = 18

plt.figure(figsize=(25, 8))

plt.title(title, fontsize=20)

Fhats = FhatI_theta_I.values()

plt.plot(thetasX, Fhats, color_style)

plt.xlabel(labelX, rotation=0, ha='right', va='center', fontweight='bold', size=xylabelsize)

plt.ylabel(labelY, rotation=0, ha='right', va='center', fontweight='bold', size=xylabelsize)

plt.show()

def plot_train(self, df, policy, comment):

# legendlabels = [r'$\mathrm{opt}$', r'$\mathrm{non}$']

n_e = len(eNames) #number of entities

n_charts = 2*n_e + 1 + 1#6

ylabelsize = 16

mpl.rcParams['lines.linewidth'] = 1.2

# plt.rcParams['axes.prop_cycle'] = plt.cycler(color=['g', 'b', 'c', 'm'])

# mycolors = {e: mycolors[i] for i,e in enumerate(eNames)}

mycolors = ['g', 'b', 'c', 'm']

fig, axs = plt.subplots(n_charts, sharex=True)

fig.set_figwidth(13); fig.set_figheight(9)

fig.suptitle(f'TRAINING OF {policy} POLICY'+'\n'+f'{comment}'+'\n'+f'L = {L}, T = {T}', fontsize=16)

for xi,e in enumerate(eNames):

axs[xi].set_ylim(auto=True); axs[xi].spines['top'].set_visible(False); axs[xi].spines['right'].set_visible(True); axs[xi].spines['bottom'].set_visible(False)

axs[xi].step(df[f'x_t_{e}'], mycolors[xi%len(mycolors)])

axs[xi].axhline(y=0, color='k', linestyle=':')

axs[xi].set_ylabel('$x_{t,'+f'{e}'+'}$', rotation=0, ha='right', va='center', fontweight='bold', size=ylabelsize)

for j in range(df.shape[0]//T): axs[xi].axvline(x=j*T, color='grey', ls=':')

xi = n_e #xi: axis index, ci: chart index on same axis

axs[xi].set_ylim(auto=True); axs[xi].spines['top'].set_visible(False); axs[xi].spines['right'].set_visible(True); axs[xi].spines['bottom'].set_visible(False)

for ci,e in enumerate(eNames):

axs[xi].step(df[f'D_t_{e}'], mycolors[ci])

axs[xi].axhline(y=dem_sim.muD[e], color='g', linestyle=':')

axs[xi].text(-4, dem_sim.muD[e], r'$\mu^{'+f'{e}'+'}$', size=16, color=mycolors[ci%len(mycolors)])

axs[xi].set_ylabel('$D_{t,e}$'+'\n'+'$\mathrm{[units]}$', rotation=0, ha='right', va='center', fontweight='bold', size=ylabelsize)

for j in range(df.shape[0]//T): axs[xi].axvline(x=j*T, color='grey', ls=':')

xi = n_e + 1

for i,e in enumerate(eNames):

axs[xi+i].set_ylim(auto=True); axs[xi+i].spines['top'].set_visible(False); axs[xi+i].spines['right'].set_visible(True); axs[xi+i].spines['bottom'].set_visible(False)

axs[xi+i].step(df[f'R_t_{e}'], mycolors[i%len(mycolors)])

axs[xi+i].axhline(y=0, color='k', linestyle=':')

axs[xi+i].set_ylabel('$R_{t,'+f'{e}'+'}$', rotation=0, ha='right', va='center', fontweight='bold', size=ylabelsize)

for j in range(df.shape[0]//T): axs[i].axvline(x=j*T, color='grey', ls=':')

xi = 2*n_e + 1 #cumC

axs[xi].set_ylim(auto=True); axs[xi].spines['top'].set_visible(False); axs[xi].spines['right'].set_visible(True); axs[xi].spines['bottom'].set_visible(False)

axs[xi].step(df['cumC'], 'k')

axs[xi].axhline(y=0, color='k', linestyle=':')

axs[xi].set_ylabel('$\mathrm{cumC}$'+'\n'+'$\mathrm{(Profit)}$'+'\n'+''+'$\mathrm{[\$]}$', rotation=0, ha='right', va='center', fontweight='bold', size=ylabelsize);

axs[xi].set_xlabel('$t\ \mathrm{[order\ windows]}$', rotation=0, ha='right', va='center', fontweight='bold', size=ylabelsize);

for j in range(df.shape[0]//T): axs[i].axvline(x=j*T, color='grey', ls=':')

# fig.legend(labels=legendlabels, loc='lower left', fontsize=16)

def plot_evalu(self, df_non, df, thetaStar):

legendlabels = [r'$\mathrm{opt}$', r'$\mathrm{non}$']

n_e = len(eNames) #number of entities

n_charts = 2*n_e + 1 + 1#6

ylabelsize = 16

mpl.rcParams['lines.linewidth'] = 1.2

mycolors = ['g', 'b', 'c', 'm']

fig, axs = plt.subplots(n_charts, sharex=True)

# fig.set_figwidth(50); fig.set_figheight(10)

fig.set_figwidth(13); fig.set_figheight(9)

fig.suptitle(f'PERFORMANCE OF OPTIMIZED Buy-Below POLICY\nOptimal (magenta), Non-optimal (cyan), '+r'$\theta^*$'+f'= {thetaStar}', fontsize=16)

for xi,e in enumerate(eNames):

axs[xi].set_ylim(auto=True); axs[xi].spines['top'].set_visible(False); axs[xi].spines['right'].set_visible(True); axs[xi].spines['bottom'].set_visible(False)

axs[xi].step(df['x_t_ELA'], 'm')

axs[xi].step(df_non['x_t_ELA'], 'c')

axs[xi].axhline(y=0, color='k', linestyle=':')

axs[xi].set_ylabel('$x_{t,'+f'{e}'+'}$', rotation=0, ha='right', va='center', fontweight='bold', size=ylabelsize)

xi = n_e #xi: axis index, ci: chart index on same axis

axs[xi].set_ylim(auto=True); axs[xi].spines['top'].set_visible(False); axs[xi].spines['right'].set_visible(True); axs[xi].spines['bottom'].set_visible(False)

for ci,e in enumerate(eNames):

axs[xi].step(df[f'D_t_{e}'], mycolors[ci])

axs[xi].text(-4, dem_sim.muD[e], r'$\mu^{'+f'{e}'+'}$', size=16, color=mycolors[ci%len(mycolors)])

axs[xi].axhline(y=dem_sim.muD[e], color='g', linestyle=':')

axs[xi].set_ylabel('$D_{t,e}$'+'\n'+'$\mathrm{[units]}$', rotation=0, ha='right', va='center', fontweight='bold', size=ylabelsize)

xi = n_e + 1

for i,e in enumerate(eNames):

axs[xi+i].set_ylim(auto=True); axs[xi+i].spines['top'].set_visible(False); axs[xi+i].spines['right'].set_visible(True); axs[xi+i].spines['bottom'].set_visible(False)

axs[xi+i].step(df[f'R_t_{e}'], 'm')

axs[xi+i].text(-4, theta_evalu[i], r'$\theta^{buy'+f'{e}'+'}$'+f"={theta_evalu[i]}", size=16, color='m')

axs[xi+i].axhline(y=theta_evalu[i], color='m', linestyle=':')

axs[xi+i].step(df_non[f'R_t_{e}'], 'c')

axs[xi+i].text(-4, theta_evalu_non[i], r'$\theta^{buy'+f'{e}'+'}$', size=16, color='c')

axs[xi+i].axhline(y=theta_evalu_non[i], color='c', linestyle=':')

axs[xi+i].text(22, theta_evalu[i+2], r'$R^{max'+f'{e}'+'}$'+f'{theta_evalu[i+2]}', size=16, color='k')

axs[xi+i].axhline(y=theta_evalu[i+2], color='k', linestyle=':') #max spaces

axs[xi+i].set_ylabel('$R_{t,'+f'{e}'+'}$'+'\n'+'$\mathrm{[units]}$', rotation=0, ha='right', va='center', fontweight='bold', size=ylabelsize)

xi = 2*n_e + 1 #cumC

axs[xi].set_ylim(auto=True); axs[xi].spines['top'].set_visible(False); axs[xi].spines['right'].set_visible(True); axs[xi].spines['bottom'].set_visible(False)

axs[xi].step(df['cumC'], 'm')

axs[xi].step(df_non['cumC'], 'c')

axs[xi].set_ylabel('$\mathrm{cumC}$'+'\n'+'$\mathrm{(Profit)}$'+'\n'+''+'$\mathrm{[\$]}$', rotation=0, ha='right', va='center', fontweight='bold', size=ylabelsize)

axs[xi].set_xlabel('$t\ \mathrm{[order\ windows]}$', rotation=0, ha='right', va='center', fontweight='bold', size=ylabelsize);

fig.legend(labels=legendlabels, loc='lower left', fontsize=16)4.6 Policy Evaluation

4.6.1 Training/Tuning

# UPDATE PARAMETERS

# T__sim = 100

L = 2*T__sim #number of sample-paths

T = T__sim #number of transitions/steps in each sample-path# create a model, policy, and demand simulator

params.update({'Algorithm': 'GridSearch'}); pprint(f'{params=}')

params.update({'R_0': (0, 0)}) #for 'R_t_ELA', 'R_t_SON'

params.update({'eta': None})

exogParams = {}# we use simulation

possibleDecisions = None

M = InventoryStorageModel(

SNames,

xNames,

eNames,

params,

exogParams,

possibleDecisions,

p__buy,

p__sell

)

M.S_0.update({

'R_t': {'ELA': params['R_0'][0], 'SON': params['R_0'][1]},

'D_t': {'ELA': 0, 'SON': 0}})

P = InventoryStoragePolicy(M, piNames)

dem_sim = DemandSimulator(

T__sim=T__sim,

muD=muD,

eventTimeD={'ELA': None, 'SON': None},

muDeltaD={'ELA': None, 'SON': None},

)("params={'Algorithm': 'GridSearch', 'T': 192, 'eta': 1, 'R__max': 57, 'R_0': "

"0, 'seed': 189654913, 'theta_sell_min': 10, 'theta_sell_max': 100, "

"'theta_buy_min': 10, 'theta_buy_max': 100, 'theta_inc': 1}")L,T(120, 60)%%time

##########################################################################

#GridSearch #. SDAM-9.4.1

if params['Algorithm'] == 'GridSearch':

thetasBuy = {'ELA': np.arange(10, 40, 1), 'SON': np.arange(10, 20, 1)}

thetasMax = {'ELA': np.arange(10, 40, 1), 'SON': np.arange(10, 40, 1)}

thetas = P.grid_search_theta_values(

thetasBuy['ELA'], thetasBuy['SON'], thetasMax['ELA'], thetasMax['SON'])

Fhat__mean_BuyBelow, Fhat__stdv_BuyBelow, thetaStar_BuyBelow, record_BuyBelow = \

P.perform_grid_search_sample_paths(T, L, thetas, 'X__BuyBelow')

##################################################################################... printing every 20th theta if considered ...

=== (820 / 270,000), theta=(10, 10, 37, 20) ===

=== (1,720 / 270,000), theta=(10, 11, 37, 20) ===

=== (2,620 / 270,000), theta=(10, 12, 37, 20) ===

=== (3,520 / 270,000), theta=(10, 13, 37, 20) ===

=== (4,420 / 270,000), theta=(10, 14, 37, 20) ===

=== (5,320 / 270,000), theta=(10, 15, 37, 20) ===

=== (6,220 / 270,000), theta=(10, 16, 37, 20) ===

=== (7,120 / 270,000), theta=(10, 17, 37, 20) ===

=== (8,020 / 270,000), theta=(10, 18, 37, 20) ===

=== (8,920 / 270,000), theta=(10, 19, 37, 20) ===

=== (9,820 / 270,000), theta=(11, 10, 37, 20) ===

=== (10,720 / 270,000), theta=(11, 11, 37, 20) ===

=== (11,620 / 270,000), theta=(11, 12, 37, 20) ===

=== (12,520 / 270,000), theta=(11, 13, 37, 20) ===

=== (13,420 / 270,000), theta=(11, 14, 37, 20) ===

=== (14,320 / 270,000), theta=(11, 15, 37, 20) ===

=== (15,220 / 270,000), theta=(11, 16, 37, 20) ===

=== (16,120 / 270,000), theta=(11, 17, 37, 20) ===

=== (17,020 / 270,000), theta=(11, 18, 37, 20) ===

=== (17,920 / 270,000), theta=(11, 19, 37, 20) ===

=== (18,820 / 270,000), theta=(12, 10, 37, 20) ===

=== (19,720 / 270,000), theta=(12, 11, 37, 20) ===

=== (20,620 / 270,000), theta=(12, 12, 37, 20) ===

=== (21,520 / 270,000), theta=(12, 13, 37, 20) ===

=== (22,420 / 270,000), theta=(12, 14, 37, 20) ===

=== (23,320 / 270,000), theta=(12, 15, 37, 20) ===

=== (24,220 / 270,000), theta=(12, 16, 37, 20) ===

=== (25,120 / 270,000), theta=(12, 17, 37, 20) ===

=== (26,020 / 270,000), theta=(12, 18, 37, 20) ===

=== (26,920 / 270,000), theta=(12, 19, 37, 20) ===

=== (27,820 / 270,000), theta=(13, 10, 37, 20) ===

=== (28,720 / 270,000), theta=(13, 11, 37, 20) ===

=== (29,620 / 270,000), theta=(13, 12, 37, 20) ===

=== (30,520 / 270,000), theta=(13, 13, 37, 20) ===

=== (31,420 / 270,000), theta=(13, 14, 37, 20) ===

=== (32,320 / 270,000), theta=(13, 15, 37, 20) ===

=== (33,220 / 270,000), theta=(13, 16, 37, 20) ===

=== (34,120 / 270,000), theta=(13, 17, 37, 20) ===

=== (35,020 / 270,000), theta=(13, 18, 37, 20) ===

=== (35,920 / 270,000), theta=(13, 19, 37, 20) ===

=== (36,820 / 270,000), theta=(14, 10, 37, 20) ===

=== (37,720 / 270,000), theta=(14, 11, 37, 20) ===

=== (38,620 / 270,000), theta=(14, 12, 37, 20) ===

=== (39,520 / 270,000), theta=(14, 13, 37, 20) ===

=== (40,420 / 270,000), theta=(14, 14, 37, 20) ===

=== (41,320 / 270,000), theta=(14, 15, 37, 20) ===

=== (42,220 / 270,000), theta=(14, 16, 37, 20) ===

=== (43,120 / 270,000), theta=(14, 17, 37, 20) ===

=== (44,020 / 270,000), theta=(14, 18, 37, 20) ===

=== (44,920 / 270,000), theta=(14, 19, 37, 20) ===

=== (45,820 / 270,000), theta=(15, 10, 37, 20) ===

=== (46,720 / 270,000), theta=(15, 11, 37, 20) ===

=== (47,620 / 270,000), theta=(15, 12, 37, 20) ===

=== (48,520 / 270,000), theta=(15, 13, 37, 20) ===

=== (49,420 / 270,000), theta=(15, 14, 37, 20) ===

=== (50,320 / 270,000), theta=(15, 15, 37, 20) ===

=== (51,220 / 270,000), theta=(15, 16, 37, 20) ===

=== (52,120 / 270,000), theta=(15, 17, 37, 20) ===

=== (53,020 / 270,000), theta=(15, 18, 37, 20) ===

=== (53,920 / 270,000), theta=(15, 19, 37, 20) ===

=== (54,820 / 270,000), theta=(16, 10, 37, 20) ===

=== (55,720 / 270,000), theta=(16, 11, 37, 20) ===

=== (56,620 / 270,000), theta=(16, 12, 37, 20) ===

=== (57,520 / 270,000), theta=(16, 13, 37, 20) ===

=== (58,420 / 270,000), theta=(16, 14, 37, 20) ===

=== (59,320 / 270,000), theta=(16, 15, 37, 20) ===

=== (60,220 / 270,000), theta=(16, 16, 37, 20) ===

=== (61,120 / 270,000), theta=(16, 17, 37, 20) ===

=== (62,020 / 270,000), theta=(16, 18, 37, 20) ===

=== (62,920 / 270,000), theta=(16, 19, 37, 20) ===

=== (63,820 / 270,000), theta=(17, 10, 37, 20) ===

=== (64,720 / 270,000), theta=(17, 11, 37, 20) ===

=== (65,620 / 270,000), theta=(17, 12, 37, 20) ===

=== (66,520 / 270,000), theta=(17, 13, 37, 20) ===

=== (67,420 / 270,000), theta=(17, 14, 37, 20) ===

=== (68,320 / 270,000), theta=(17, 15, 37, 20) ===

=== (69,220 / 270,000), theta=(17, 16, 37, 20) ===

=== (70,120 / 270,000), theta=(17, 17, 37, 20) ===

=== (71,020 / 270,000), theta=(17, 18, 37, 20) ===

=== (71,920 / 270,000), theta=(17, 19, 37, 20) ===

=== (72,820 / 270,000), theta=(18, 10, 37, 20) ===

=== (73,720 / 270,000), theta=(18, 11, 37, 20) ===

=== (74,620 / 270,000), theta=(18, 12, 37, 20) ===

=== (75,520 / 270,000), theta=(18, 13, 37, 20) ===

=== (76,420 / 270,000), theta=(18, 14, 37, 20) ===

=== (77,320 / 270,000), theta=(18, 15, 37, 20) ===

=== (78,220 / 270,000), theta=(18, 16, 37, 20) ===

=== (79,120 / 270,000), theta=(18, 17, 37, 20) ===

=== (80,020 / 270,000), theta=(18, 18, 37, 20) ===

=== (80,920 / 270,000), theta=(18, 19, 37, 20) ===

=== (81,820 / 270,000), theta=(19, 10, 37, 20) ===

=== (82,720 / 270,000), theta=(19, 11, 37, 20) ===

=== (83,620 / 270,000), theta=(19, 12, 37, 20) ===

=== (84,520 / 270,000), theta=(19, 13, 37, 20) ===

=== (85,420 / 270,000), theta=(19, 14, 37, 20) ===

=== (86,320 / 270,000), theta=(19, 15, 37, 20) ===

=== (87,220 / 270,000), theta=(19, 16, 37, 20) ===

=== (88,120 / 270,000), theta=(19, 17, 37, 20) ===

=== (89,020 / 270,000), theta=(19, 18, 37, 20) ===

=== (89,920 / 270,000), theta=(19, 19, 37, 20) ===

=== (90,820 / 270,000), theta=(20, 10, 37, 20) ===

=== (91,720 / 270,000), theta=(20, 11, 37, 20) ===

=== (92,620 / 270,000), theta=(20, 12, 37, 20) ===

=== (93,520 / 270,000), theta=(20, 13, 37, 20) ===

=== (94,420 / 270,000), theta=(20, 14, 37, 20) ===

=== (95,320 / 270,000), theta=(20, 15, 37, 20) ===

=== (96,220 / 270,000), theta=(20, 16, 37, 20) ===

=== (97,120 / 270,000), theta=(20, 17, 37, 20) ===

=== (98,020 / 270,000), theta=(20, 18, 37, 20) ===

=== (98,920 / 270,000), theta=(20, 19, 37, 20) ===

=== (99,820 / 270,000), theta=(21, 10, 37, 20) ===

=== (100,720 / 270,000), theta=(21, 11, 37, 20) ===

=== (101,620 / 270,000), theta=(21, 12, 37, 20) ===

=== (102,520 / 270,000), theta=(21, 13, 37, 20) ===

=== (103,420 / 270,000), theta=(21, 14, 37, 20) ===

=== (104,320 / 270,000), theta=(21, 15, 37, 20) ===

=== (105,220 / 270,000), theta=(21, 16, 37, 20) ===

=== (106,120 / 270,000), theta=(21, 17, 37, 20) ===

=== (107,020 / 270,000), theta=(21, 18, 37, 20) ===

=== (107,920 / 270,000), theta=(21, 19, 37, 20) ===

=== (108,820 / 270,000), theta=(22, 10, 37, 20) ===

=== (109,720 / 270,000), theta=(22, 11, 37, 20) ===

=== (110,620 / 270,000), theta=(22, 12, 37, 20) ===

=== (111,520 / 270,000), theta=(22, 13, 37, 20) ===

=== (112,420 / 270,000), theta=(22, 14, 37, 20) ===

=== (113,320 / 270,000), theta=(22, 15, 37, 20) ===

=== (114,220 / 270,000), theta=(22, 16, 37, 20) ===

=== (115,120 / 270,000), theta=(22, 17, 37, 20) ===

=== (116,020 / 270,000), theta=(22, 18, 37, 20) ===

=== (116,920 / 270,000), theta=(22, 19, 37, 20) ===

=== (117,820 / 270,000), theta=(23, 10, 37, 20) ===

=== (118,720 / 270,000), theta=(23, 11, 37, 20) ===

=== (119,620 / 270,000), theta=(23, 12, 37, 20) ===

=== (120,520 / 270,000), theta=(23, 13, 37, 20) ===

=== (121,420 / 270,000), theta=(23, 14, 37, 20) ===

=== (122,320 / 270,000), theta=(23, 15, 37, 20) ===

=== (123,220 / 270,000), theta=(23, 16, 37, 20) ===

=== (124,120 / 270,000), theta=(23, 17, 37, 20) ===

=== (125,020 / 270,000), theta=(23, 18, 37, 20) ===

=== (125,920 / 270,000), theta=(23, 19, 37, 20) ===

=== (126,820 / 270,000), theta=(24, 10, 37, 20) ===

=== (127,720 / 270,000), theta=(24, 11, 37, 20) ===

=== (128,620 / 270,000), theta=(24, 12, 37, 20) ===

=== (129,520 / 270,000), theta=(24, 13, 37, 20) ===

=== (130,420 / 270,000), theta=(24, 14, 37, 20) ===

=== (131,320 / 270,000), theta=(24, 15, 37, 20) ===

=== (132,220 / 270,000), theta=(24, 16, 37, 20) ===

=== (133,120 / 270,000), theta=(24, 17, 37, 20) ===

=== (134,020 / 270,000), theta=(24, 18, 37, 20) ===

=== (134,920 / 270,000), theta=(24, 19, 37, 20) ===

=== (135,820 / 270,000), theta=(25, 10, 37, 20) ===

=== (136,720 / 270,000), theta=(25, 11, 37, 20) ===

=== (137,620 / 270,000), theta=(25, 12, 37, 20) ===

=== (138,520 / 270,000), theta=(25, 13, 37, 20) ===

=== (139,420 / 270,000), theta=(25, 14, 37, 20) ===

=== (140,320 / 270,000), theta=(25, 15, 37, 20) ===

=== (141,220 / 270,000), theta=(25, 16, 37, 20) ===

=== (142,120 / 270,000), theta=(25, 17, 37, 20) ===

=== (143,020 / 270,000), theta=(25, 18, 37, 20) ===

=== (143,920 / 270,000), theta=(25, 19, 37, 20) ===

=== (144,820 / 270,000), theta=(26, 10, 37, 20) ===

=== (145,720 / 270,000), theta=(26, 11, 37, 20) ===

=== (146,620 / 270,000), theta=(26, 12, 37, 20) ===

=== (147,520 / 270,000), theta=(26, 13, 37, 20) ===

=== (148,420 / 270,000), theta=(26, 14, 37, 20) ===

=== (149,320 / 270,000), theta=(26, 15, 37, 20) ===

=== (150,220 / 270,000), theta=(26, 16, 37, 20) ===

=== (151,120 / 270,000), theta=(26, 17, 37, 20) ===

=== (152,020 / 270,000), theta=(26, 18, 37, 20) ===

=== (152,920 / 270,000), theta=(26, 19, 37, 20) ===

=== (153,820 / 270,000), theta=(27, 10, 37, 20) ===

=== (154,720 / 270,000), theta=(27, 11, 37, 20) ===

=== (155,620 / 270,000), theta=(27, 12, 37, 20) ===

=== (156,520 / 270,000), theta=(27, 13, 37, 20) ===

=== (157,420 / 270,000), theta=(27, 14, 37, 20) ===

=== (158,320 / 270,000), theta=(27, 15, 37, 20) ===

=== (159,220 / 270,000), theta=(27, 16, 37, 20) ===

=== (160,120 / 270,000), theta=(27, 17, 37, 20) ===

=== (161,020 / 270,000), theta=(27, 18, 37, 20) ===

=== (161,920 / 270,000), theta=(27, 19, 37, 20) ===

=== (162,820 / 270,000), theta=(28, 10, 37, 20) ===

=== (163,720 / 270,000), theta=(28, 11, 37, 20) ===

=== (164,620 / 270,000), theta=(28, 12, 37, 20) ===

=== (165,520 / 270,000), theta=(28, 13, 37, 20) ===

=== (166,420 / 270,000), theta=(28, 14, 37, 20) ===

=== (167,320 / 270,000), theta=(28, 15, 37, 20) ===

=== (168,220 / 270,000), theta=(28, 16, 37, 20) ===

=== (169,120 / 270,000), theta=(28, 17, 37, 20) ===

=== (170,020 / 270,000), theta=(28, 18, 37, 20) ===

=== (170,920 / 270,000), theta=(28, 19, 37, 20) ===

=== (171,820 / 270,000), theta=(29, 10, 37, 20) ===

=== (172,720 / 270,000), theta=(29, 11, 37, 20) ===

=== (173,620 / 270,000), theta=(29, 12, 37, 20) ===

=== (174,520 / 270,000), theta=(29, 13, 37, 20) ===

=== (175,420 / 270,000), theta=(29, 14, 37, 20) ===

=== (176,320 / 270,000), theta=(29, 15, 37, 20) ===

=== (177,220 / 270,000), theta=(29, 16, 37, 20) ===

=== (178,120 / 270,000), theta=(29, 17, 37, 20) ===

=== (179,020 / 270,000), theta=(29, 18, 37, 20) ===

=== (179,920 / 270,000), theta=(29, 19, 37, 20) ===

=== (180,820 / 270,000), theta=(30, 10, 37, 20) ===

=== (181,720 / 270,000), theta=(30, 11, 37, 20) ===

=== (182,620 / 270,000), theta=(30, 12, 37, 20) ===

=== (183,520 / 270,000), theta=(30, 13, 37, 20) ===

=== (184,420 / 270,000), theta=(30, 14, 37, 20) ===

=== (185,320 / 270,000), theta=(30, 15, 37, 20) ===

=== (186,220 / 270,000), theta=(30, 16, 37, 20) ===

=== (187,120 / 270,000), theta=(30, 17, 37, 20) ===

=== (188,020 / 270,000), theta=(30, 18, 37, 20) ===

=== (188,920 / 270,000), theta=(30, 19, 37, 20) ===

=== (189,820 / 270,000), theta=(31, 10, 37, 20) ===

=== (190,720 / 270,000), theta=(31, 11, 37, 20) ===

=== (191,620 / 270,000), theta=(31, 12, 37, 20) ===

=== (192,520 / 270,000), theta=(31, 13, 37, 20) ===

=== (193,420 / 270,000), theta=(31, 14, 37, 20) ===

=== (194,320 / 270,000), theta=(31, 15, 37, 20) ===

=== (195,220 / 270,000), theta=(31, 16, 37, 20) ===

=== (196,120 / 270,000), theta=(31, 17, 37, 20) ===

=== (197,020 / 270,000), theta=(31, 18, 37, 20) ===

=== (197,920 / 270,000), theta=(31, 19, 37, 20) ===

=== (198,820 / 270,000), theta=(32, 10, 37, 20) ===

=== (199,720 / 270,000), theta=(32, 11, 37, 20) ===

=== (200,620 / 270,000), theta=(32, 12, 37, 20) ===

=== (201,520 / 270,000), theta=(32, 13, 37, 20) ===

=== (202,420 / 270,000), theta=(32, 14, 37, 20) ===

=== (203,320 / 270,000), theta=(32, 15, 37, 20) ===

=== (204,220 / 270,000), theta=(32, 16, 37, 20) ===

=== (205,120 / 270,000), theta=(32, 17, 37, 20) ===

=== (206,020 / 270,000), theta=(32, 18, 37, 20) ===

=== (206,920 / 270,000), theta=(32, 19, 37, 20) ===

=== (207,820 / 270,000), theta=(33, 10, 37, 20) ===

=== (208,720 / 270,000), theta=(33, 11, 37, 20) ===

=== (209,620 / 270,000), theta=(33, 12, 37, 20) ===

=== (210,520 / 270,000), theta=(33, 13, 37, 20) ===

=== (211,420 / 270,000), theta=(33, 14, 37, 20) ===

=== (212,320 / 270,000), theta=(33, 15, 37, 20) ===

=== (213,220 / 270,000), theta=(33, 16, 37, 20) ===

=== (214,120 / 270,000), theta=(33, 17, 37, 20) ===

=== (215,020 / 270,000), theta=(33, 18, 37, 20) ===

=== (215,920 / 270,000), theta=(33, 19, 37, 20) ===

=== (216,820 / 270,000), theta=(34, 10, 37, 20) ===

=== (217,720 / 270,000), theta=(34, 11, 37, 20) ===

=== (218,620 / 270,000), theta=(34, 12, 37, 20) ===

=== (219,520 / 270,000), theta=(34, 13, 37, 20) ===

=== (220,420 / 270,000), theta=(34, 14, 37, 20) ===

=== (221,320 / 270,000), theta=(34, 15, 37, 20) ===

=== (222,220 / 270,000), theta=(34, 16, 37, 20) ===

=== (223,120 / 270,000), theta=(34, 17, 37, 20) ===

=== (224,020 / 270,000), theta=(34, 18, 37, 20) ===

=== (224,920 / 270,000), theta=(34, 19, 37, 20) ===

=== (225,820 / 270,000), theta=(35, 10, 37, 20) ===

=== (226,720 / 270,000), theta=(35, 11, 37, 20) ===

=== (227,620 / 270,000), theta=(35, 12, 37, 20) ===

=== (228,520 / 270,000), theta=(35, 13, 37, 20) ===

=== (229,420 / 270,000), theta=(35, 14, 37, 20) ===

=== (230,320 / 270,000), theta=(35, 15, 37, 20) ===

=== (231,220 / 270,000), theta=(35, 16, 37, 20) ===

=== (232,120 / 270,000), theta=(35, 17, 37, 20) ===

=== (233,020 / 270,000), theta=(35, 18, 37, 20) ===

=== (233,920 / 270,000), theta=(35, 19, 37, 20) ===

=== (234,820 / 270,000), theta=(36, 10, 37, 20) ===

=== (235,720 / 270,000), theta=(36, 11, 37, 20) ===

=== (236,620 / 270,000), theta=(36, 12, 37, 20) ===

=== (237,520 / 270,000), theta=(36, 13, 37, 20) ===

=== (238,420 / 270,000), theta=(36, 14, 37, 20) ===

=== (239,320 / 270,000), theta=(36, 15, 37, 20) ===

=== (240,220 / 270,000), theta=(36, 16, 37, 20) ===

=== (241,120 / 270,000), theta=(36, 17, 37, 20) ===

=== (242,020 / 270,000), theta=(36, 18, 37, 20) ===

=== (242,920 / 270,000), theta=(36, 19, 37, 20) ===

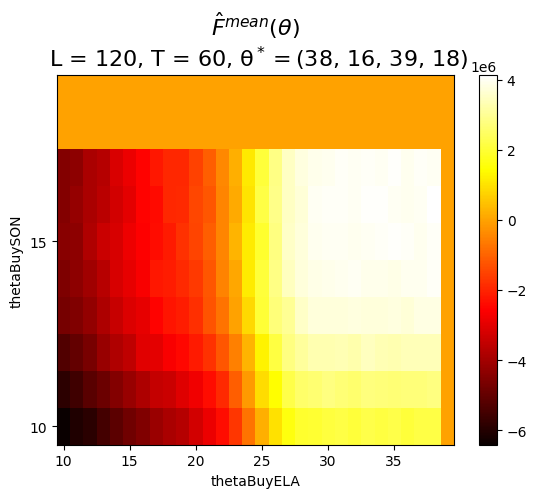

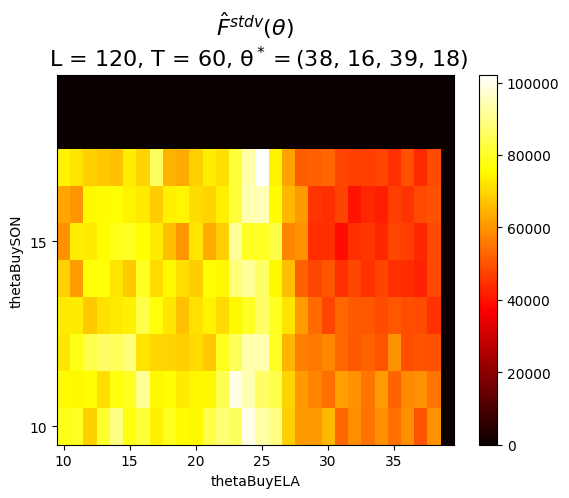

Finishing GridSearch in 948.47 secs

Best theta: (38, 16, 39, 18). Best cumC: 4,135,296.250000002

CPU times: user 15min 25s, sys: 11.8 s, total: 15min 37s

Wall time: 15min 48sP.plot_Fhat_maps(

Fhat__mean_BuyBelow,

Fhat__stdv_BuyBelow,

thetasBuy['ELA'],

thetasBuy['SON'],

'thetaBuyELA',

'thetaBuySON',

r"$\hat{F}^{mean}(\theta)$"+f"\n L = {L}, T = {T}, "+r"$\mathrm{\theta^*} =$"+f"{thetaStar_BuyBelow}",

r"$\hat{F}^{stdv}(\theta)$"+f"\n L = {L}, T = {T}, "+r"$\mathrm{\theta^*} =$"+f"{thetaStar_BuyBelow}",

thetaStar_BuyBelow[2],

thetaStar_BuyBelow[3],

)

TrueR_t_labels = ['R_t_'+e for e in eNames]

D_t_labels = ['D_t_'+e for e in eNames]

x_t_labels = ['x_t_'+e for e in eNames]

labels = ['piName', 'theta', 'l'] + \

['t'] + R_t_labels + D_t_labels + ['cumC'] + x_t_labels

# labelsf'{len(record_BuyBelow):,}', L, T('28,684,800', 120, 60)df_X__BuyBelow = pd.DataFrame.from_records(record_BuyBelow[:200], columns=labels)

# df_X__BuyBelow = pd.DataFrame.from_records(record_BuyBelow[-100:], columns=labels)

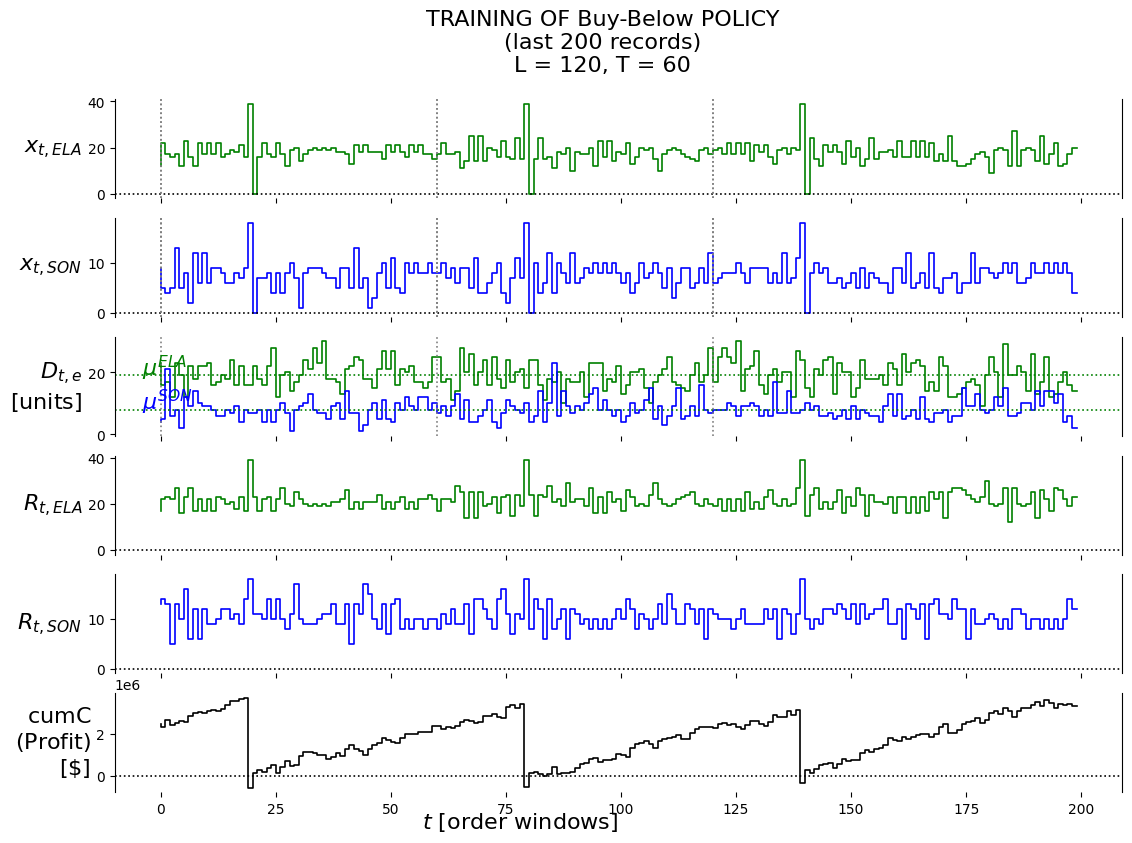

P.plot_train(df_X__BuyBelow, 'Buy-Below', '(first 200 records)')

df_X__BuyBelow.head()| piName | theta | l | t | R_t_ELA | R_t_SON | D_t_ELA | D_t_SON | cumC | x_t_ELA | x_t_SON | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | X__BuyBelow | (10, 10, 18, 39) | 1 | 0 | 18 | 39 | 17 | 8 | -592,545.6500 | 18 | 39 |

| 1 | X__BuyBelow | (10, 10, 18, 39) | 1 | 1 | 1 | 31 | 12 | 7 | -378,561.3000 | 0 | 0 |

| 2 | X__BuyBelow | (10, 10, 18, 39) | 1 | 2 | 17 | 24 | 16 | 7 | -398,796.9500 | 17 | 0 |

| 3 | X__BuyBelow | (10, 10, 18, 39) | 1 | 3 | 1 | 17 | 26 | 8 | -157,562.6000 | 0 | 0 |

| 4 | X__BuyBelow | (10, 10, 18, 39) | 1 | 4 | 17 | 9 | 20 | 6 | -510,158.2500 | 17 | 0 |

# df_X__BuyBelow = pd.DataFrame.from_records(record[:100], columns=labels)

df_X__BuyBelow = pd.DataFrame.from_records(record_BuyBelow[-200:], columns=labels)

P.plot_train(df_X__BuyBelow, 'Buy-Below', '(last 200 records)')

df_X__BuyBelow.head()| piName | theta | l | t | R_t_ELA | R_t_SON | D_t_ELA | D_t_SON | cumC | x_t_ELA | x_t_SON | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | X__BuyBelow | (38, 17, 39, 18) | 117 | 40 | 17 | 13 | 23 | 4 | 2,490,238.3500 | 12 | 9 |

| 1 | X__BuyBelow | (38, 17, 39, 18) | 117 | 41 | 22 | 14 | 16 | 5 | 2,325,852.7000 | 22 | 5 |

| 2 | X__BuyBelow | (38, 17, 39, 18) | 117 | 42 | 23 | 13 | 17 | 21 | 2,662,357.0500 | 17 | 4 |

| 3 | X__BuyBelow | (38, 17, 39, 18) | 117 | 43 | 22 | 5 | 12 | 6 | 2,442,711.4000 | 16 | 5 |

| 4 | X__BuyBelow | (38, 17, 39, 18) | 117 | 44 | 27 | 13 | 23 | 8 | 2,557,635.7500 | 17 | 13 |

4.6.2 Evaluation

# EVALUATION

piName_evalu = 'X__BuyBelow'

stop_time_evalu = T__simM_evalu = InventoryStorageModel(

SNames,

xNames,

eNames,

params,

exogParams,

possibleDecisions,

p__buy,

p__sell

)

M_evalu.S_0.update({

'R_t': {'ELA': params['R_0'][0], 'SON': params['R_0'][1]},

'D_t': {'ELA': 0, 'SON': 0}})

P_evalu = InventoryStoragePolicy(M_evalu, piNames)

dem_sim = DemandSimulator(

T__sim=T__sim,

muD=muD, #19, 8

eventTimeD={'ELA': None, 'SON': None},

muDeltaD={'ELA': None, 'SON': None},

)def run_policy_evalu(piInfo_evalu, piName_evalu, stop_time_evalu, model_copy):

record = []

for t in range(stop_time_evalu):

x_t = getattr(P_evalu, piName_evalu)(t, model_copy.S_t, piInfo_evalu, stop_time_evalu)

S_t, cumC, x_t = model_copy.step(t, x_t) # step the model forward one iteration

record_t = \

[S_t.R_t[e] for e in eNames] + \

[S_t.D_t[e] for e in eNames] + \

[cumC] + \

[x_t.x_t[e] for e in eNames]

record.append(record_t)

cumC = model_copy.cumC

return cumC, record4.6.2.1 Evalutate with data similar to train data

4.6.2.1.1 Non-optimal policy

# theta_evalu_non=(3, 3)

# theta_evalu_non=(10, 10, 11, 11)

theta_evalu_non=(20, 10, 40, 17)

piName_evalu_non = 'X__BuyBelow'

cumC, record = run_policy_evalu(theta_evalu_non, piName_evalu_non, stop_time_evalu, copy(M_evalu))

labels = ['R_t_ELA', 'R_t_SON', 'D_t_ELA', 'D_t_SON', "cumC", 'x_t_ELA', 'x_t_SON']

print(f'{theta_evalu_non=}')

print(f'{int(cumC)=:,}')

df_non = pd.DataFrame.from_records(data=record, columns=labels); df_non[:10]theta_evalu_non=(20, 10, 40, 17)

int(cumC)=-2,767,808| R_t_ELA | R_t_SON | D_t_ELA | D_t_SON | cumC | x_t_ELA | x_t_SON | |

|---|---|---|---|---|---|---|---|

| 0 | 40 | 17 | 15 | 8 | -577,885.6500 | 40 | 17 |

| 1 | 25 | 9 | 25 | 8 | 226,628.7000 | 0 | 0 |

| 2 | 0 | 9 | 19 | 9 | 294,843.0500 | 0 | 8 |

| 3 | 40 | 8 | 20 | 5 | -494,472.6000 | 40 | 8 |

| 4 | 20 | 12 | 35 | 10 | 48,291.7500 | 0 | 9 |

| 5 | 20 | 2 | 20 | 7 | -166,093.9000 | 20 | 0 |

| 6 | 20 | 15 | 20 | 13 | -196,429.5500 | 20 | 15 |

| 7 | 20 | 2 | 24 | 9 | -58,765.2000 | 20 | 0 |

| 8 | 20 | 15 | 18 | 8 | -420,670.8500 | 20 | 15 |

| 9 | 22 | 7 | 26 | 12 | -99,816.5000 | 20 | 0 |

4.6.2.1.2 Optimal policy

theta_evalu = thetaStar_BuyBelow

piName_evalu = 'X__BuyBelow'

cumC, record = run_policy_evalu(theta_evalu, piName_evalu, stop_time_evalu, copy(M_evalu))

labels = ['R_t_ELA', 'R_t_SON', 'D_t_ELA', 'D_t_SON', "cumC", 'x_t_ELA', 'x_t_SON']

print(f'{theta_evalu=}')

print(f'{int(cumC)=:,}')

df = pd.DataFrame.from_records(data=record, columns=labels); df[:10]theta_evalu=(38, 16, 39, 18)

int(cumC)=4,150,531| R_t_ELA | R_t_SON | D_t_ELA | D_t_SON | cumC | x_t_ELA | x_t_SON | |

|---|---|---|---|---|---|---|---|

| 0 | 39 | 18 | 14 | 10 | -549,655.6500 | 39 | 18 |

| 1 | 25 | 8 | 18 | 10 | 90,568.7000 | 0 | 0 |

| 2 | 21 | 10 | 16 | 5 | 56,403.0500 | 14 | 10 |

| 3 | 23 | 13 | 12 | 7 | 4,357.4000 | 18 | 8 |

| 4 | 27 | 11 | 18 | 3 | 89,031.7500 | 16 | 5 |

| 5 | 21 | 15 | 18 | 5 | 261,206.1000 | 12 | 7 |

| 6 | 21 | 13 | 17 | 9 | 491,510.4500 | 18 | 3 |

| 7 | 22 | 9 | 20 | 7 | 693,524.8000 | 18 | 5 |

| 8 | 19 | 11 | 18 | 6 | 752,249.1500 | 17 | 9 |

| 9 | 21 | 12 | 26 | 4 | 813,183.5000 | 20 | 7 |

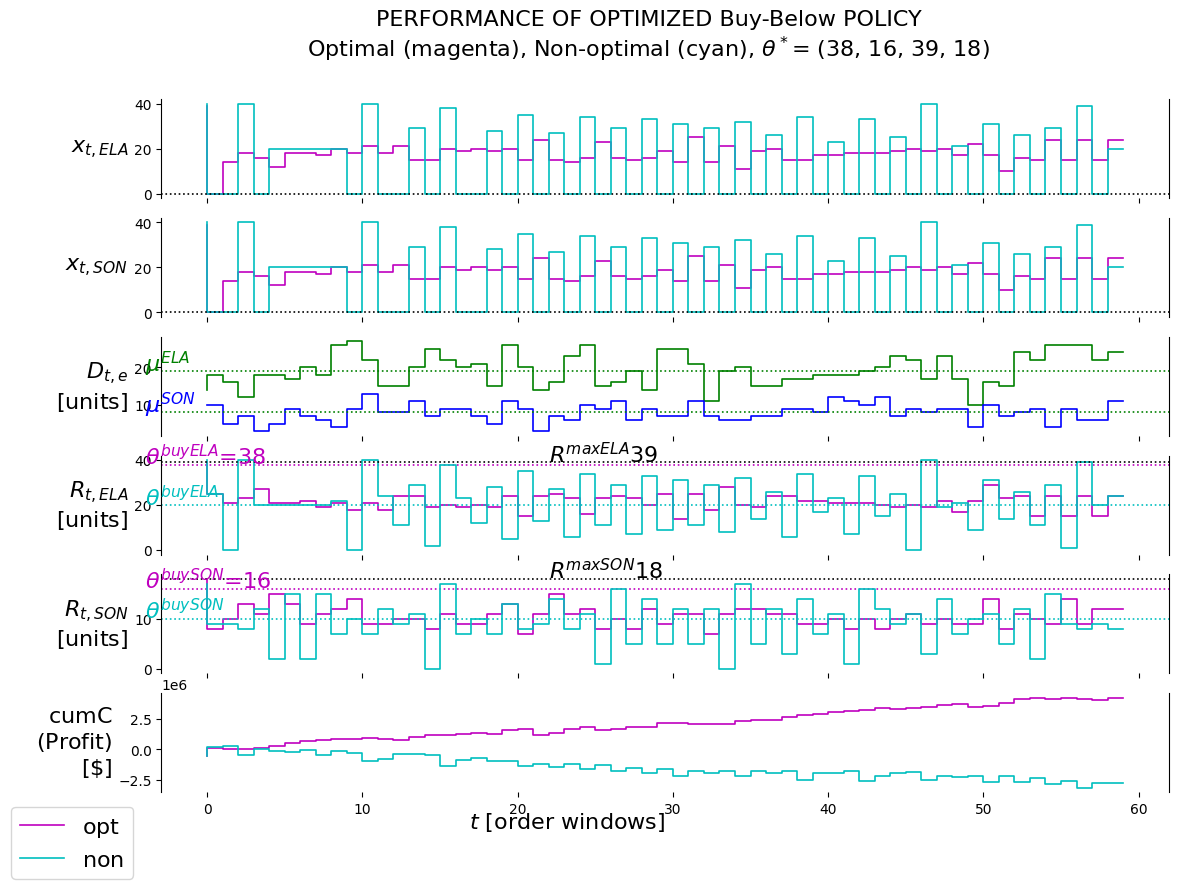

P.plot_evalu(df_non, df, thetaStar_BuyBelow)

From the cumC plot we see that the cumulative reward for the optimal policy keeps on rising. The non-optimal, status-quo policy keeps losing money. Mr. Optimal currently has a partitioning of 40/17 spaces for Elantras/Sonatas. When levels fall below 20/10 he reorders up to 40/17. The optimal policy prescribes that Elantras/Sonatas should be partitioned 39/18 and ordered up to 38/16. Overall, it must be encouraging for Mr. Optimal that his partitioning was not too far from optimal. However, if he changes to the optimal policy, he stands to gain about a 175% improvement in profitability over a 100 order windows.